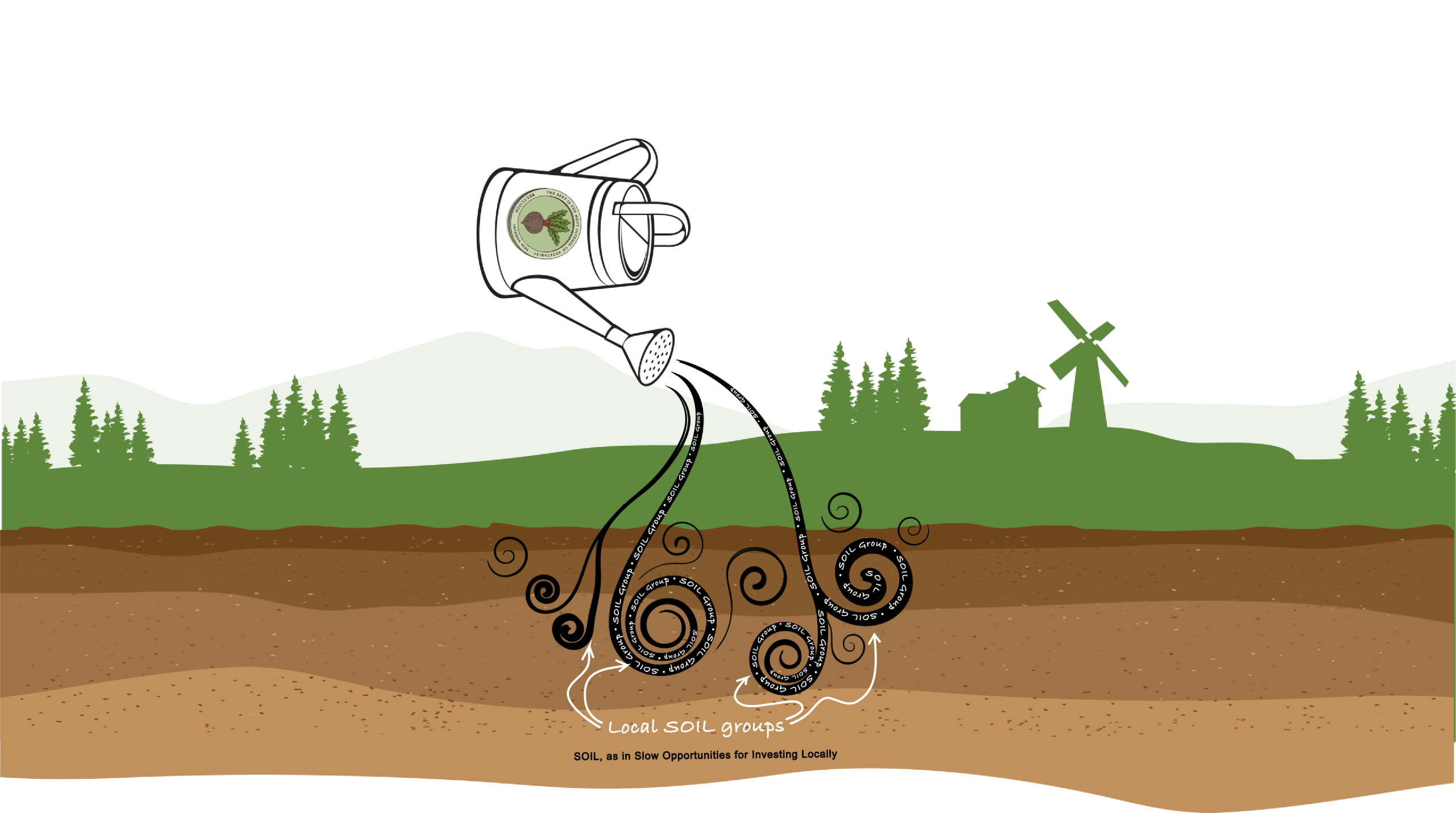

The Slow Money Institute collects Beetcoin donations and steers them to local groups as matching grants, where they work in tandem with locally raised capital. When loans are repaid, all capital stays local, recirculating in perpetuity.

Making an individual donation or loan to an organic farm is a good thing. Doing so as part of a growing network and A MOVEMENT that promotes economic healing, an even better thing. This is bottom-up systemic change.

Linking the breadth of the internet to the depth of local knowledge. Creating slow-growing, community-driven pools of capital that catalyze grassroots participation and promote community resilience.

There are currently seven nonprofit local groups that make 0% loans. The first started in 2015 in Carbondale, CO. Over the next few years, three other groups formed in Colorado, one in Massachusetts and one in Virginia. In 2024, our newest group started in Israel.

To date, this first cohort of pioneering groups has provided $5+ million to more than 300 farms and food enterprises.

Exploratory discussions regarding new groups are underway in Rhode Island, the Netherlands, Uruguay, and China.

Berkshire Agricultural Ventures | Great Barrington, MA

Would you like to

0% is a clear, simple and unequivocal stand as an alternative to finance as usual. We are prioritizing people and place over the arithmetic of extraction.

Books could be written about the purpose and impact of 0% loans. Oh, wait. . .a few have been. . .

Shocker of all shockers: In professional financial circles, profit almost always comes before people and planet, no matter how earnestly triple-bottom-line concerns are expounded.

Money keeps going faster and faster, corporations keep getting bigger and bigger, wealth inequality keeps widening, the planet keeps heating up, and global markets keep taking precedence over pretty much everything.

0%, because we recognize that family farms and local food businesses are not typically very profitable, even when successful, even though they generate vital social and ecological benefits.

You can call it trust. You can call it community. It’s both of these, but it’s also conscientious affection:

"In response to military crisis, a few extraordinary souls may choose the difficult and complicated path of conscientious objection. In response to the collateral damage of globalization, the choice to become a conscientious investor is far less dramatic, far less binary, far friendlier—driven, sure, by being mad as hell and not wanting to take it anymore, but at a deeper level by a sense of conscientious affection."